Tax Treatment of the California Middle Class Tax Refund

The IRS has issued guidance on the tax treatment of the California Middle Class Tax Refund (MCTR), as well as payments made to qualified residents in 20 additional states. IRS 2023-23 states that taxpayers will not need to report these tax payments on their 2022 tax returns in the ‘interest of sound tax administration.’

The bureau noted that the payments it reviewed, including the Middle Class Tax Refund were most often sent as special tax refunds or payments related to the pandemic, and that they would qualify as payments made under the General Welfare Doctrine or Qualified Disaster Relief Payment. Furthermore, it will not challenge the tax treatment chosen when filing 2022.

What is the California Middle Class Tax Refund?

In 2022, the State of California issued more than $9 billion in payments to the benefit of approximately 31.6 million qualified taxpayers and their dependents. Eligible taxpayers received these tax payments automatically through direct deposit and or debit card. While a majority of the payments have been made, the state has noted that there may be some lingering payments issue in coming months.

If you’re not sure you received a California Middle Class Tax Refund payment, check the eligibility requirements here.

If you were eligible, you would have automatically received a payment between October 2022 and January 2023. For payments issued by debit cards, the return address of the envelope is Omaha, NE. The MCTR website has a picture of what the envelope and debit cards look like. You would receive payment by mail in the form of a debit card if you filed a paper return or had a balance due.

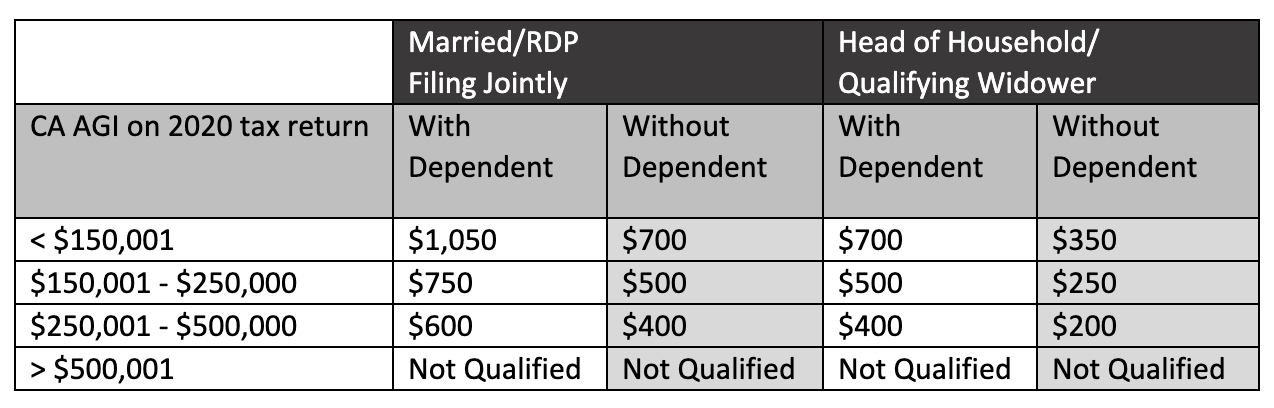

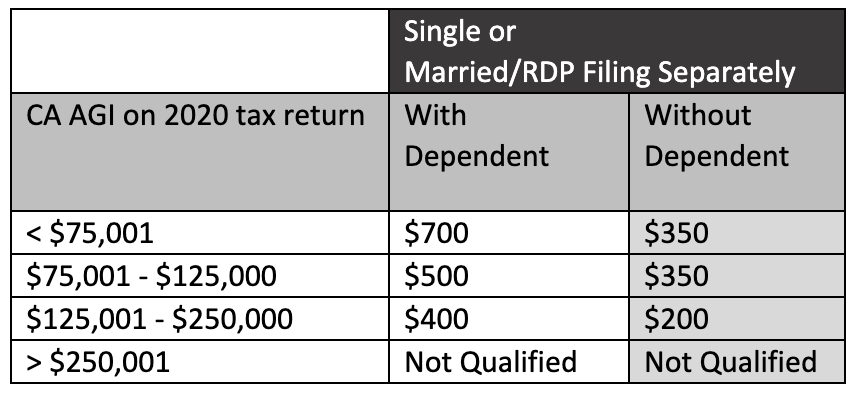

What you may receive

According to the MCTR website, the amount received by qualified taxpayers is dependent on the AGI on the 2020 California State Tax Return and filing status. Here are the amounts:

Frequently Asked Questions:

What if I didn’t receive a payment?

Verify the eligibility requirements listed above. If you believe you should have received a payment and have not yet received it, contact MCTR customer support Monday through Friday from 8 am to 5 pm Pacific Time by:

- Chat/Online: mctrpayment.com

- Phone: 800-542-9332

Can I get cash from my debit card?

If you received your MCTR payment on a debit card, you may access cash through one of the below methods. Other methods may have fees associated that the individual is responsible for.

- Cashback on purchases: Use the debit card and request cash back at participating retailers that accept VISA debit cards.

- In-network ATMs: Withdraw funds at an in-network ATM. Find an ATM here.

- Bank transfer: Activate and register your debit card at mctrpayment.com. From there, recipients can request a transfer to their bank account.

When will I receive my payment?

Most payments have already been processed. To check the list of dates payments were issued, visit the MCTR website here.

What if my personal information has changed?

If your bank account or mailing address has changed since filing your 2020 Tax Return, the following actions should be taken:

- Bank information: The payment will be reissued as a debit card and sent through the mail. It may take 10-14 weeks for this to be processed.

- Address change: View and edit your address information through MyFTB or contact customer support at mctrpayment.com or 800-542-9332.

Can I amend my return to qualify for the MCTR?

Amending or filing your 2020 tax return will ‘not qualify taxpayers for the MCTR payment.’

What if I need to return the payment?

Whether you believe your received the payment in error or do not want the payment, you can return the money to the Franchise Tax Board by following these instructions.

I received a 1099-MISC for the payment. Now what?

Taxpayers that received payments in the amount of $600 or greater will receive a 1099-MISC for this payment. As these funds are not taxable by the State of California or the federal government, taxpayers do not need to claim the payment as income on your tax return.

What do I do if I received a card for a family member who is now deceased?

If you received a payment for a person who is now deceased, the payment might not be in error. Individuals who filed in a status other than single or who claimed a dependent on their 2020 tax returns might qualify for a payment. If a person was deceased on the day the payment was issued and they filed as single without a dependent, they are not qualified for the payment.

For additional questions, click here.